Taxes paid by energy storage projects

Welcome to our dedicated page for Taxes paid by energy storage projects! Here, we have carefully selected a range of videos and relevant information about Taxes paid by energy storage projects, tailored to meet your interests and needs. Our services include high-quality Taxes paid by energy storage projects-related products and solutions, designed to serve a global audience across diverse regions.

We proudly serve a global community of customers, with a strong presence in over 20 countries worldwide—including but not limited to the United States, Canada, Mexico, Brazil, the United Kingdom, France, Germany, Italy, Spain, the Netherlands, Australia, India, Japan, South Korea, China, Russia, South Africa, Egypt, Turkey, and Saudi Arabia.

Wherever you are, we're here to provide you with reliable content and services related to Taxes paid by energy storage projects, including cutting-edge solar energy storage systems, advanced lithium-ion batteries, and tailored solar-plus-storage solutions for a variety of industries. Whether you're looking for large-scale industrial solar storage or residential energy solutions, we have a solution for every need. Explore and discover what we have to offer!

Tax-exempt investment in partnerships holding energy properties

Partnership allocations are critical If tax – exempt entities invest in energy projects through partnerships, careful consideration should be given to allocations under the respective

WhatsApp

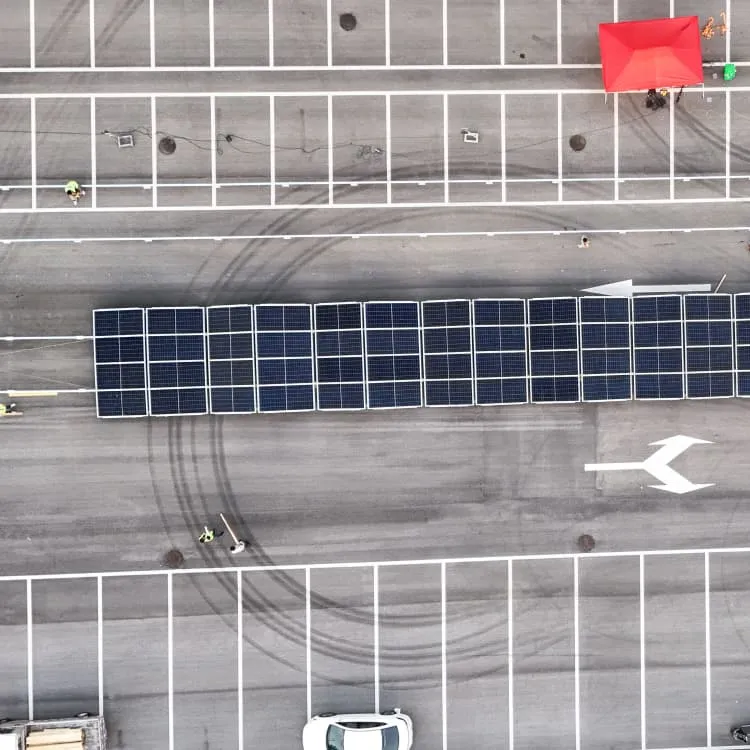

Solar, storage projects set to bring jobs, tax revenue to Illinois

Solar, storage projects set to bring jobs, tax revenue to Illinois coal communities A recent state procurement formalizes plans to put solar and storage on the site of several

WhatsApp

Summary of Inflation Reduction Act provisions related to renewable energy

This page summarizes information in the Inflation Reduction Act related to renewable energy project tax provisions. While EPA does have some Inflation Reduction Act

WhatsApp

Evaluation of the role of existing and potential tax incentives

Evaluation of the role of existing and potential tax incentives in achieving Maine''s energy storage policy goals Submitted by the Governor''s Energy Office to the Joint Standing Committee on

WhatsApp

Inflation Reduction Act Creates New Tax Credit Opportunities for Energy

Energy storage installations that begin construction after Dec. 31, 2024, will be entitled to credits under the technology-neutral ITC under new Section 48E (discussed below).

WhatsApp

The State of Play for Energy Storage Tax Credits – Publications

The energy storage industry has continued to progress over the course of 2024 and into 2025, buoyed in significant part by the federal income tax benefits in the form of tax credits

WhatsApp

How much tax is paid per acre for energy storage projects?

Tax rates for energy storage projects can vary widely due to several significant factors including the geographic location, project size, and local government policies.

WhatsApp

Publication 6045 (Rev. 2-2025)

To calculate the amount your § 48 or § 48E project is eligible for, multiply the applicable tax credit percentage by the "tax basis," or the amount spent on an eligible unit of energy property or

WhatsApp

What the budget bill means for energy storage tax credit eligibility

Unlike solar and wind, which had their construction cutoff dates moved up, BESS projects will remain eligible for the investment tax credit (ITC) and production tax credit (PTC)

WhatsApp

How to Claim the Energy Storage Tax Credit

This incentive functions as a dollar-for-dollar reduction of taxes owed for a portion of the cost of an eligible energy storage system. This credit is available for both individual

WhatsApp

Battery storage tax credit opportunities and development challenges

Credit rate is only six percent for projects that start construction 60 days after guidance and do not meet the wage and apprenticeship requirements. Bonus credits.

WhatsApp

SALT and Battery: Taxes on Energy Storage | Tax Notes

In this installment of Andersen''s Sodium Podium, the authors discuss the differing property tax and sales tax considerations regarding battery energy storage systems and

WhatsApp

The Economic Impact of Renewable Energy and Energy

Over 75% of Texas counties are expected to receive tax revenues from either wind, solar, or energy stor-age projects. For aggregate values in this report, wind and solar projects were

WhatsApp

U.S. Department of the Treasury Releases Final Rules to Expand

Final rules will improve access to direct pay for co-owned clean energy projects, helping to expand the buildout of the clean energy economy.WASHINGTON – Today, the U.S.

WhatsApp

Clean Energy Tax Incentives: Elective Pay Eligible Tax Credits

Clean Energy Tax Incentives: Elective Pay Eligible Tax Credits The Inflation Reduction Act of 2022 ("IRA") makes several clean energy tax credits available to businesses; tax-exempt

WhatsAppFAQs 6

What is the base tax credit for energy projects?

• For projects beginning construction on or after Jan. 29, 2023 or where the maximum net output is 1 MW or greater, the base tax credit is 6% of the taxpayer’s basis in the energy property or qualified facility (or energy storage technology).

Are IRA tax benefits a viable option for energy storage facilities?

While the vitality of the IRA tax benefits in their current form is currently subject to uncertainty given the results of the 2024 federal general election, the existing market practice for financing energy storage facilities since the IRA’s passage continues to evolve in reaction to the act’s new requirements and opportunities.

How has the energy storage industry progressed in 2024 & 2025?

The energy storage industry has continued to progress over the course of 2024 and into 2025, buoyed in significant part by the federal income tax benefits in the form of tax credits enacted under the Inflation Reduction Act of 2022 (IRA).

Who can install energy-generation & storage property?

Tax-exempt and governmental entities, such as state and local governments, Tribes, religious organizations, and non-profits may install energy-generation and storage property to meet energy demands, reach clean energy transition goals, or save money on energy costs.

Are energy storage projects eligible for a refundable ITC?

Energy storage projects owned by taxable entities are not eligible for a refundable ITC, but instead can take advantage of the new transferability rules. The IRA added a provision to permit project owners (other than tax-exempt entities) to make an election to transfer the ITC to an unrelated third party.

What is the energy storage credit and how does it work?

The credit ranges from 30 percent to as much as 70 percent for nonresidential installations if certain domestic content and community-related criteria can be met. This credit is expected to increase investments in energy storage and capacity additions to 27 gigawatts a year by 2031. 1

More industry content

- Albania lithium iron phosphate battery pack factory

- The role of DC screen inverter

- How long does the hybrid energy of a communication base station last

- Luxembourg photovoltaic integrated panel pressing tile manufacturer

- Mauritania Behind-the-User Energy Storage Project

- How much is the price of a solar base station in Panama

- Commercial Energy Storage Power Cabinet

- How to install photovoltaic energy storage cabinets at the site

- Photovoltaic panel 2A monocrystalline

- 12v 24V to 380V inverter

- Cooled energy storage cabinet manufacturer in Uzbekistan

- Vietnam recommended energy storage lithium battery companies

- Monaco home inverter sales manufacturer

- Swaziland 580W photovoltaic panel manufacturer

- Energy storage lithium iron phosphate battery 12v 100ah battery

- Rooftop photovoltaic power generation per panel per day

- Yemen Solar Power Generation System

- Advantages and disadvantages of cabinet-type energy storage products

- North Macedonia outdoor inverter brand ranking

- Does Madagascar produce batteries for energy storage cabinets

- Myanmar s reliable energy storage container brand

- Comoros inverter manufacturer